This patch includes:

1) required updates for the NYS Healthcare Workers Bonus (HWB) Program, and

2) and Excel Macro that automates the creation of the NYS HWB file.

NYS Healthcare Workers Bonus (HWB) Program Update

As part of the 2022-2023 enacted New York State Budget, Governor Hochul and the State Legislature allocated $1.2 billion in funding to the NYS Health Care Worker Bonus (HWB) program for the payment of bonuses for certain frontline health care workers. NY State has allowed facilities who failed to submit prior to the September 3rd deadline to file for Vesting Period #1 during the window for filing for Vesting Period #2 – October 1st thru October 31st. The facility can also file at that time for employees who whose attestation forms were received late by the facility.

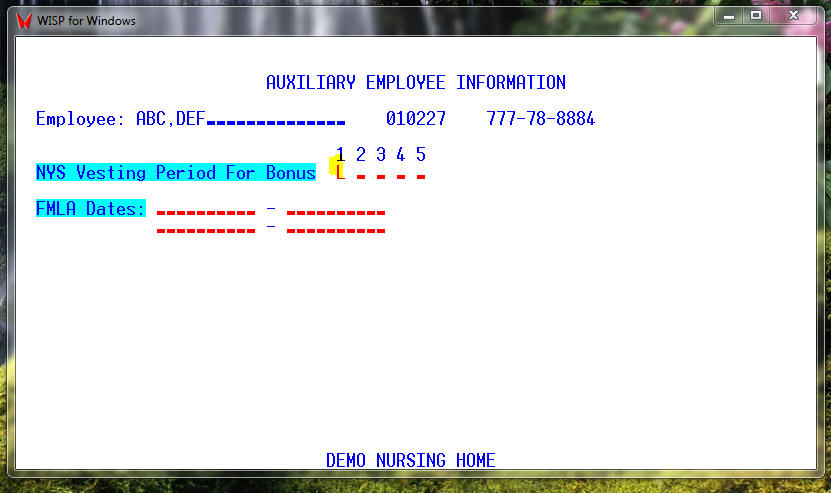

We have updated the Auxiliary Employee information screen to allow for a Late filing indicator. This will enable the facility to select only those employees when creating the NY State HWB file from within CHARTS.

Auxiliary Employee Information – AUXINFO [PR, 8, 1, 2, 15]

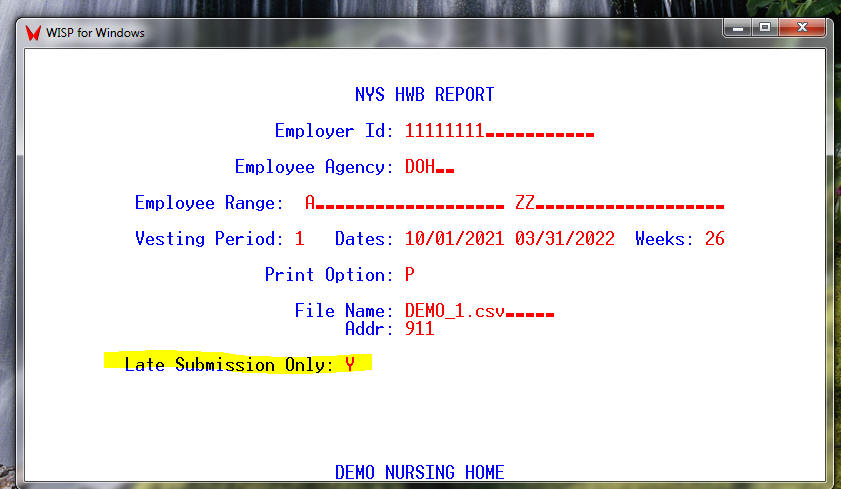

NYS HWB Report – NYHWB [PR, 9, 15, 9]

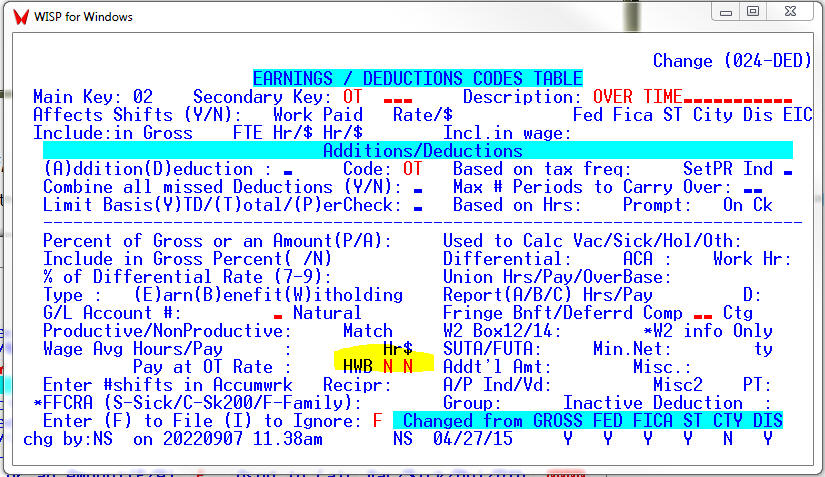

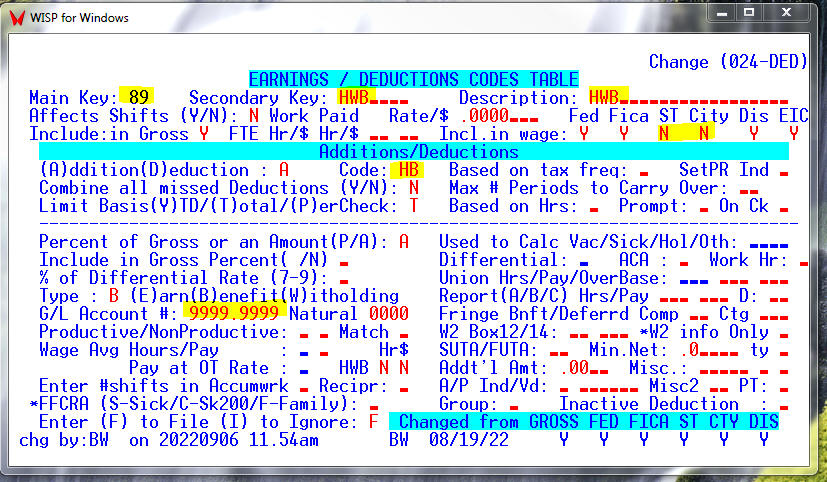

Change Table File [CTF, 10, 1] – Department Table and [CTF, 10, 3] – Earnings and Deduction Table

As a reminder, based on the latest information, all overtime hours and wages should not be used in NYHWB calculations. Please make sure that your table file is properly set up for all overtime type hours.

Distributing the NYS HWB Bonus to Employees

Providers/Employers will see the HWB bonus as a Lump Sum (HWB-HW Bonus) line item on their Medicaid remittance at the same time they normally receive their remittance for an eMedNY claim cycle, whether it’s an electronic or a paper remittance. If they receive electronic remittances, they will see the remittance prior to receiving payment. If they receive a paper remit, the paper will accompany the remittance. In addition, there may be information about the payment on the HWB Program Portal.

In CHARTS the bonus should be recorded using Addition/Deduction Code #89 which has been loaded to your CHARTS table as part of the release. HWB bonus payments to employees are exempt from both NYS and local income tax (in municipalities such as New York City), but regarding FICA and Federal income tax purposes, bonuses are considered supplemental wages and are required to be included as wages on the employee’s W-2.

Please note: This addition has been set as a ‘Benefit’ and not as an ‘Earning’ for General ledger purposes with a temporary ‘9999.9999’ GL account number. Make sure to modify the General Ledger account number prior to posting your payroll to the general ledger.

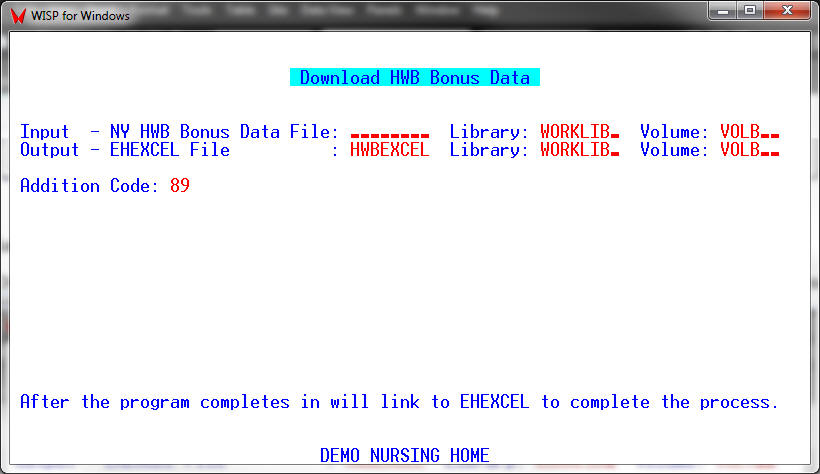

Load the HWB Bonus into Payroll – HWBBONUS [PR, 9, 15, 11]

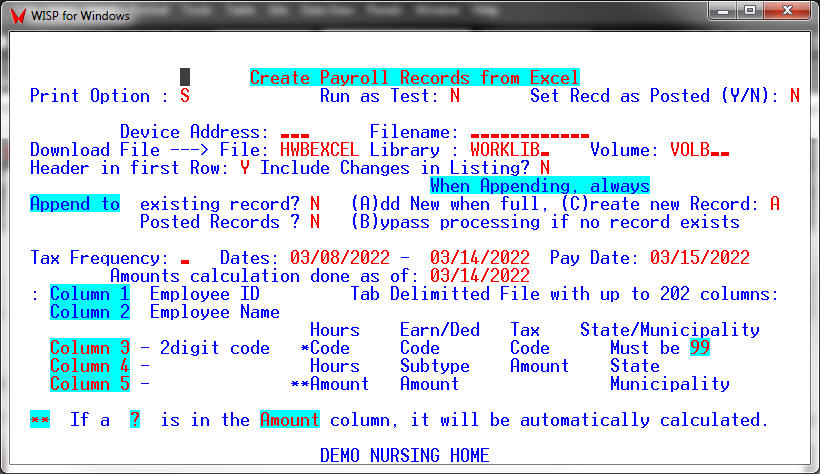

Once the Bonus File is available at the HWB Portal, please download the file to your computer. Open the Excel file and save the file as a TAB DELIMITED file to the CHARTS work folder usually R:\rhs\volb\worklib. The file name should be no loner that 8 characters. The file can then be used to create a payroll records by running a newly created program, HWBBONUS from any CHARTS menu.

The HWBBONUS program will convert the NY State HWB bonus file into an Excel formatted file that will be used by EHEXCEL, which will automatically be called to create the applicable payroll records.

Using the HWBCREATE Macro

As part of this release an Excel Macro has been installed into the CHARTS folder that can be used to automate the creation of the NY HWB file from the Excel file created via the NYHWB program [PR, 9, 15, 9].

The following are the basic steps:

- Position yourself to the CHARTS folder – usually R:\rhs\volb\CHARTS

- Click on HWBCREATE.XLMS file

- Follow the simple prompts:

- Click Enable Content (if a security warning appears)

- Select an input file – the csv file created by the NYHWB program

- Save the output file (using a new name for the output file).

- Log on to the NY State HWB portal and submit the newly created output file

One additional point, sometimes your network security will not allow the macro to run. In that case try copying the CREATEHWB.XLMS file to a folder on your local C drive and try running the macro from there.

THE END