This patch includes:

1) Updated Federal and New York State Tax Tables for 2022, and

2) a program to reset the 2022 therapy threshold amounts.

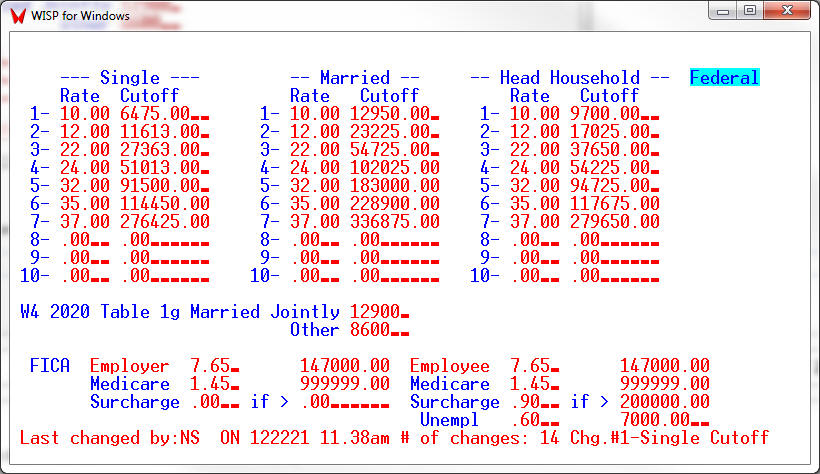

Federal Tax Tables for 2022

The Federal Tax Table has been modified. This release automatically updates the Federal Tax table when the release is loaded.

The FICA limit for 2022 has been increased from $142,800 to $147,000 for both employee and employer. These limits are updated on this release. The FICA rates remain unchanged from 2021.

The Federal Tax Table for 2022 to be used when the W-4 is from 2019 or earlier or when the box in Step 2 of the W-4 is NOT checked:

The Federal Tax Table for 2022 to be used when the box in Step 2 of the W-4 is checked :

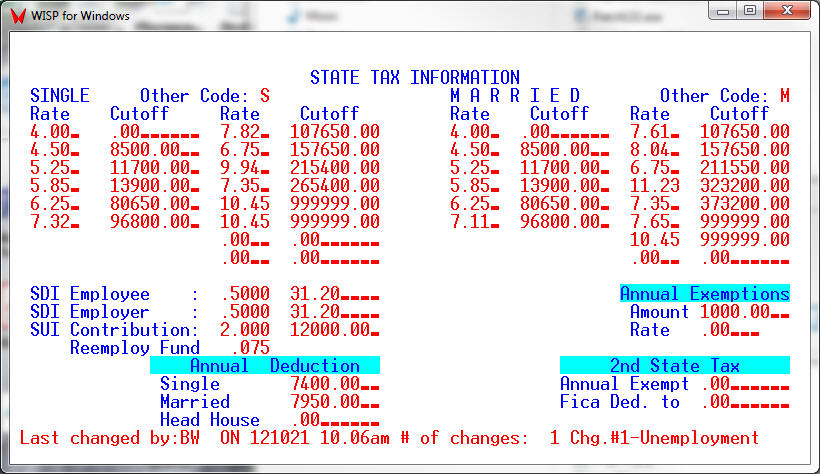

New York State Tax Table for 2022

The New York State Tax Table has been modified. This release automatically updates the New York State table when the release is loaded.

Please note: For 2022 the SUI Contribution limit has been increased to $12,000.

The New York State Tax Table for 2022:

Resetting the Therapy Threshold Amounts Used

Please run the ‘SETLIMIT’ program to reset the limits after all ancillary charges for 2021 have been posted, but before 2022 ancillary charges are posted.

The SETLIMIT program [GM, 18, 12, 2 ] resets the 2022 therapy dollars used to zero.

The screen will Display “Press Enter – to reset Therapy Limits (Jan. ’22)“

At the point simply press Enter.

Please Note: For 2022 the therapy cap limit has been increased from $2,110 to $2,150. The 2022 limit is automatically set when the release is loaded. The additional limits remain unchanged at $3,000 for both PT and Speech combined and OT.

THE END