This patch includes:

1) Updated Medicare PDPM rates and Wage Index tables, and

2) Software midifications for billing Medicare gap days using Occurrence Span 76.

Medicare PDPM Rates and Wage Index Update

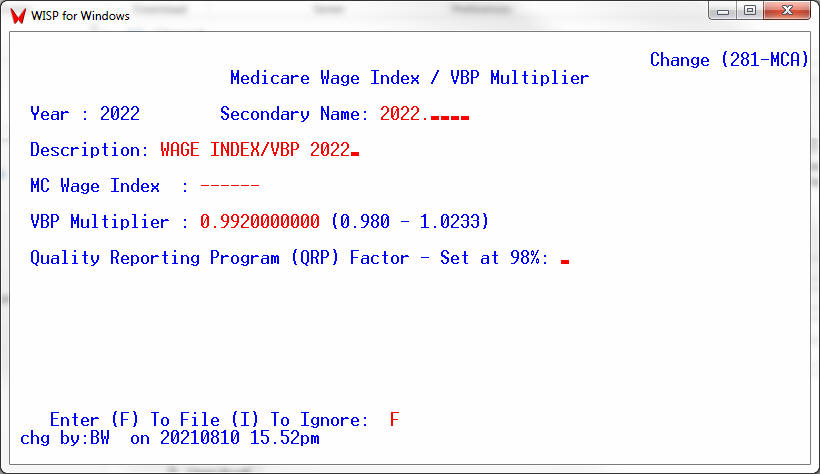

PDPM went into effect starting October 1, 2019. Each October CMS updates the associated PDPM rates for Urban and Rural facilities along with the wage index for each county. The tables required to calculate expected PDPM payments have been downloaded as part of this release. For fiscal 2022 only the VBP Multiplier has been set to 0.992 for all facilities. The VBP Multiplier has also been loaded as part of this release. [The only exception is SNFs subject to the low-volume scoring adjustment, which would receive 100 percent of their 2 percent withhold. Those facilities would need to enter a VBP Multiplier of 1.00 in the Wage Index / VBP table for fiscal 2022.]

Please note that the software updates the wage index based on the Urban or Rural Indicator and CBSA code on file in User Parameters [UP, screen #3].

Change Table File [CTF] – 8, 34 – Wage Index / VBP Table for fiscal 2022

The Wage index and VBP Multiplier should have been set upon loading the update.

Billing Medicare Gap Days Using Occurrence Span 76

With PDPM billing, each time a resident is away from the nursing facility for 3 consecutive days a new MDS is required and the PDPM rate adjusts to the higher day 1 rate. The same should apply if a Medicare resident becomes non-skilled for a 3 day or more time period. Until now, CMS has been paying those claims at a lower rate. CMS was not properly adjusting their calculation. For example if on day 11 of his Medicare stay, the resident becomes non-skilled and is again picked up by Medicare one week later, Medicare was paying the new stay at the PDPM day 11 rate. They should have been paying day 11 as day 1 on the PDPM rate scale..

The recently updated Medicare Claims Processing Manual states that “For claims that contain both covered days and non-covered days, and those non-covered days are the responsibility of the beneficiary (e.g., days submitted for non-covered level of care), the provider should append occurrence span code 76 to indicate the days the beneficiary is liable”. This allows the facility to communicate to Medicare that the new Medicare stay should be paid as day 1 on the PDPM rate scale.

When doing a Change in Status [CC, 4] if the software detects that there has been a non-skilled gap in coverage of 3 days or more for a Medicare resident it will prompt the user with the applicable 76 Occurrence Span dates.

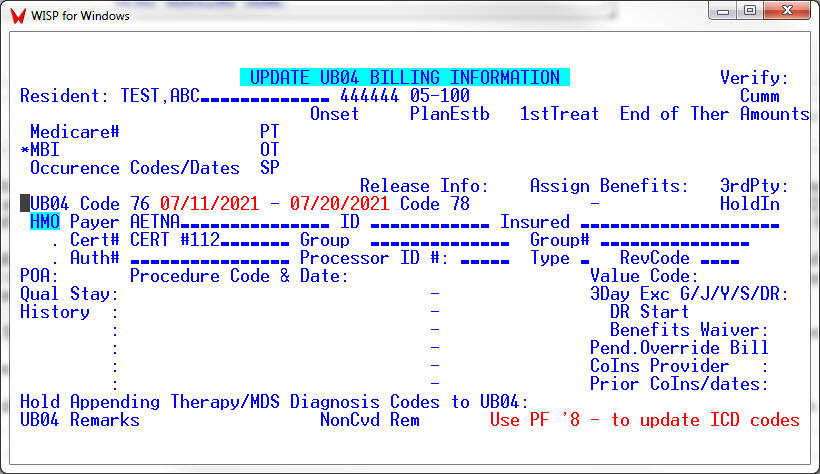

To modify historical information, the Code 76 Occurrence Span can also be modified using the UB04INFO screen [AR, 2, 7].

The UB04 program upon detecting a Code 76 span occurring during the billing period, will produce a single bill covering both Medicare stays during the month and treating the Code 76 span as non-covered days. This will alert Medicare to pay the new Medicare stay starting at the day 1 PDPM rate.

UB04INFO [AR, 2, 7]

THE END