This patch includes:

1) an updated list of ICD 10 diagnosis codes effective October 2021,

2) updates related to billing PT and OT assistants at 85% of the allowable Part B rate starting January 2022, and

3) a revised version of the Employer’s Quarterly Tax Return (IRS Form 941) which was updated for reporting 2021 Q2.

ICD 10 Diagnosis Codes Update

The Centers for Medicare & Medicaid Services (CMS) recently released the 2022 version of the ICD-10-CM files. The 2022 files contain information on the ICD-10-CM coding updates for the 2022 fiscal year. These 2022 ICD-10-CM codes are to be used for billing for discharges occurring from October 1, 2021 through September 30, 2022, and for patient encounters occurring from October 1, 2021 through September 30, 2022.

This release incorporates these new ICD 10 diagnosis codes into the CHARTS ICD 10 diagnosis tables.

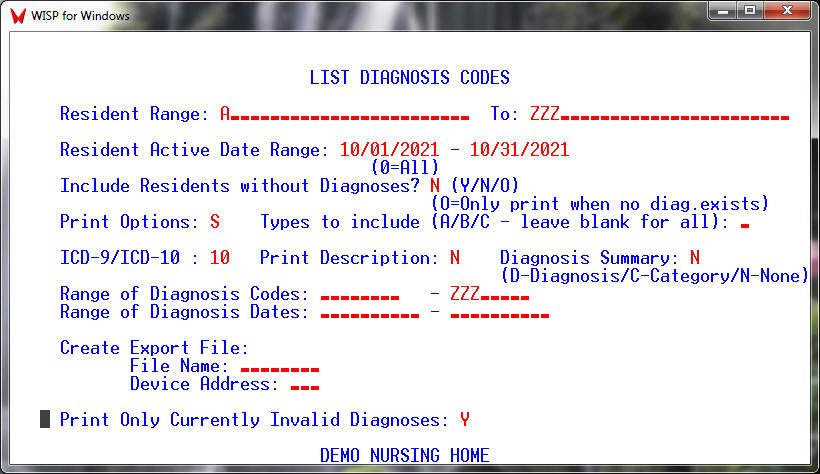

After loading this update, it is recommended that facilities run a LIST RESIDENT ICD10 CODES REPORT – “LISTICD” [CC, 5, 7] with ‘Print Only Currently Invalid Diagnoses’ set to ‘Y’ to determine which diagnosis codes currently on file will become invalid in October 2021.

Billing for PT and OT assistants with modifiers CQ and CO

You may be aware when Congress passed the Bipartisan Budget Act in 2018 it directed CMS to establish a payment differential for services, provided in whole or in part, by physical therapist assistants (PTA) and occupational therapist assistants (OTA). CMS finalized the rule actualizing that legislation last year putting it into effect beginning January 2020. Also in that ruling CMS instructed that new modifiers, CQ for work provided by PTA’s and CO for work provided by OTA’s would need to be attached to those services, as listed on the claim, exceeding the 10% time threshold. These modifiers are to be included on the claim on the same lines where any GP or GO modifiers are provided (basically any physical therapy or occupational therapy code).

As part of the Bipartisan Budget Act Congress directed CMS to establish a payment differential for services, provided in whole or in part, by physical therapist assistants (PTA) and occupational therapist assistants (OTA). The payment rate is 85% of the rate physical therapists and occupational therapists are paid. The change in reimbursement will begin with visits on or after January 1, 2022.

CHARTS will automatically adjust the rate for any Part B charges encountered on or after January 1, 2022 where a modifier ‘CQ’ or ‘CO’ is present.

Employer’s Quarterly Tax Return (IRS Form 941) Updated for 2021 Q2

The Employer’s Quarterly Federal Tax Return (IRS Form 941) has been updated for reporting Q2 of the 2021 tax year. The changes are related to the employee retention credit and the extension of the COVID-19 credit for qualified sick and family leave as extended by the American Rescue Plan of 2021 (ARP).

THE END