CHARTS Patch 130: April 2021: Employee Retention Credit (ERC) Update

The update includes:

1) updates related to the extension of the existing Covid-19 public health emergency through July 2021, and

2) software updates that assist in filing for the Employee Retention Credit (ERC).

Extention of Covid-19 Emergency through July 2021

On April 15, 2021, Xavier Becerra, the recently appointed Secretary of Health and Human Services renewed the Covid-19 public health emergency declaration that has been in place since January 2020 for an additional 90 days. The CHARTS billing software has been updated to reflect that extension through July 2021.

Employee Retention Credit (ERC)

Under the recently enacted American Rescue Plan Act and previously under the Consolidated Appropriations Act, 2021, the employee retention credit, a provision of the CARES Act, is extended and expanded. It can be claimed through Dec. 31, 2021 to eligible employers who retained employees during the COVID-19 pandemic. The CHARTS software now included a program that created an Excel that assists facilities in calculating their allowed retention credit.

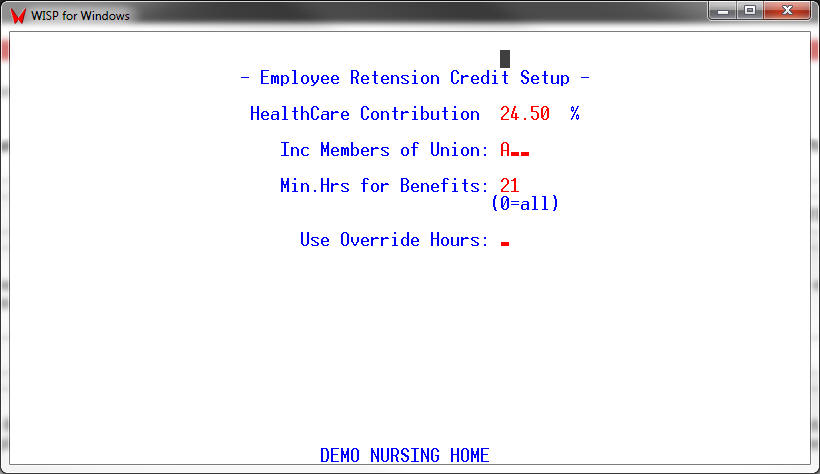

ERC Set UP – PR, 5, 14, 4 [ERCSETUP]- set up Union Welfare Information (Health Insurance)

Note: The entries on the screen are for illustration purposes only. Please enter the appropriate healthcare contribution, union list and minimum hours for benefits that are appropriate for your facility.

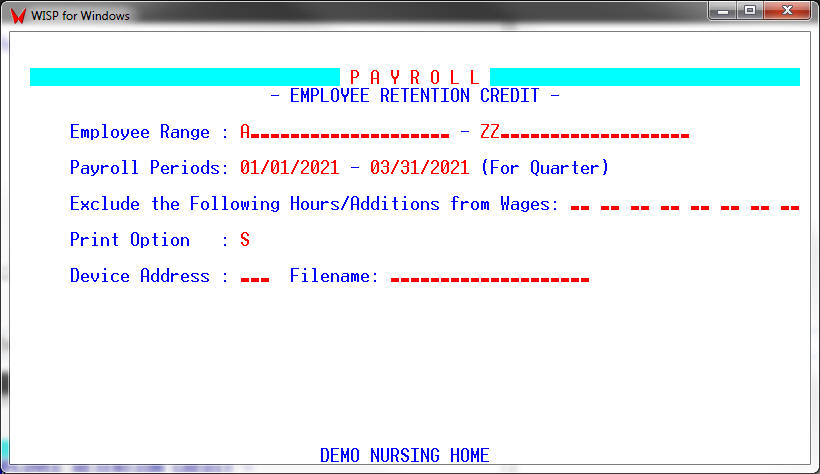

Run the ERC Report and Create ERC Excel File – PR, 5, 14, 3 [ERC]

Set the dates to the appropriate quarter. The program will calculate FICA wages to be included in the report and Excel file. You have the ability exclude any hours or additions from the calculation. For example Covid pay that you will be claiming a credit for, this will exclude double counting those wages.

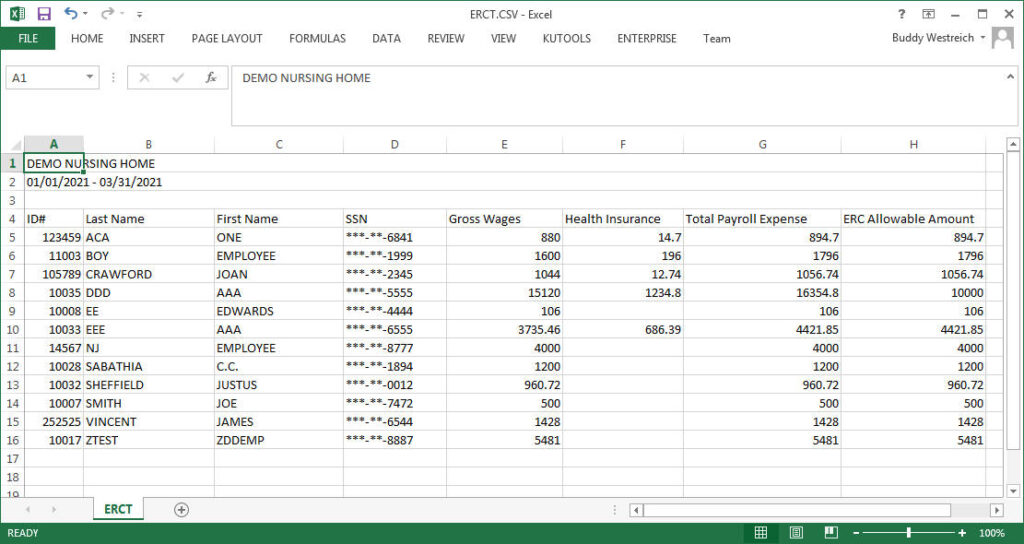

An Excel report will be created that can be used to determine your ERC credit.

Please remember that wages paid to related individuals, as defined by section 51(i)(1) of the Internal Revenue Code are not taken into account for purposes of the Employee Retention Credit and must be deleted from the spreadsheet before finalizing your ERC credit. A related individual is any employee who has of any of the following relationships to the employee’s employer who is an individual:

- A child or a descendant of a child;

- A brother, sister, stepbrother, or stepsister;

- The father or mother, or an ancestor of either;

- A stepfather or stepmother;

- A niece or nephew;

- An aunt or uncle;

- A son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law.

Sample ERC Excel File

The cost of health insurance can only be determined for union employees. For non-union or management employees earning under $10,000 in the quarter, the cost of health care coverage would need to be entered manually.

The End.