Affordable Care Act Update 2021

Filing Deadlines

The filing deadline for employers to provide employees with a copy of their 2021 1095-C reporting form, as required by the Affordable Care Act, is January 31, 2022. The deadline for electronic submissions to the IRS is March 31, 2022 (submit filing via AATRIX by March 29th to guarantee compliance).

Lowest Cost for Offer of Coverage Code ‘1A’ Increased for 2021

The lowest monthly amount the employee could have paid under the plan for self-coverage only (the cost for covering spouse or dependents is not included) and use Offer of Coverage code ‘1A’ was $101.79 for the 2020 tax year. In 2021 this amount has increased to $104.53 (based on 9.83% of $12,760, the 2020 poverty level). In 2021, if the lowest monthly amount the employee could have paid is less than $104.53 per month for minimum value coverage as defined by the law, Offer of Coverage Code ‘1A’ can be used. If the lowest monthly amount is more than $104.53, Code ‘1A’ cannot be used and the employer should fill in the amount on the form (line 15) and use one of the ‘Safe Harbor Codes’, if applicable, to show that the employer is in compliance.

[For 2022 plans using the Poverty Level Safe Harbor to determine affordability, the employee’s premium payment will not be able to exceed $103.15 per month (based on 9.61% of $12,880 the 2021 poverty level).]

Plan Start Month

This box on the 1095-C Form became required in 2020. To complete this box on the 1095-C a two-digit number (01 through 12) indicating the calendar month during which the plan year begins of the health plan in which the employee is offered coverage (or would be offered coverage if the employee were eligible to participate in the plan) is entered. If more than one plan year could apply (for instance, if the employer changes the plan year during the year), enter the earliest applicable month. If there is no health plan under which coverage is offered to the employee, enter “00”. To facilitate entering the Start Plan Month for all employees, RHS has provided for a Default Plan Month for the facility and also the ability to override the Start Plan Month for each ACA group.

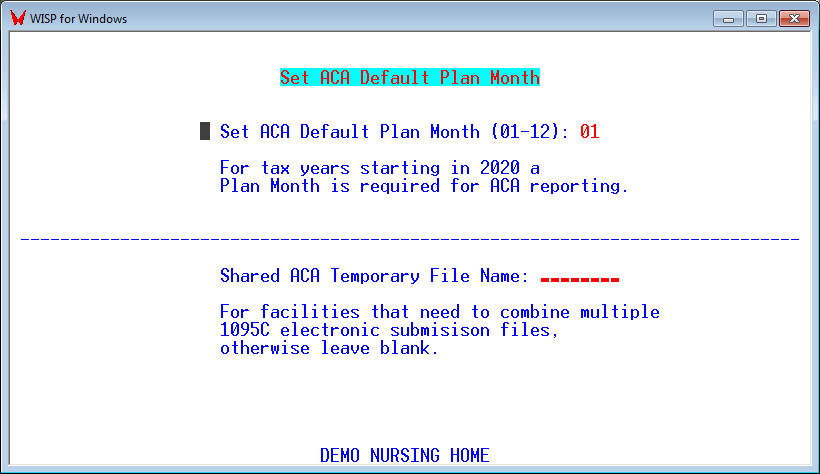

Set ACA Default Start Month – [ACAMONTH – PR, 8, 9, 8]

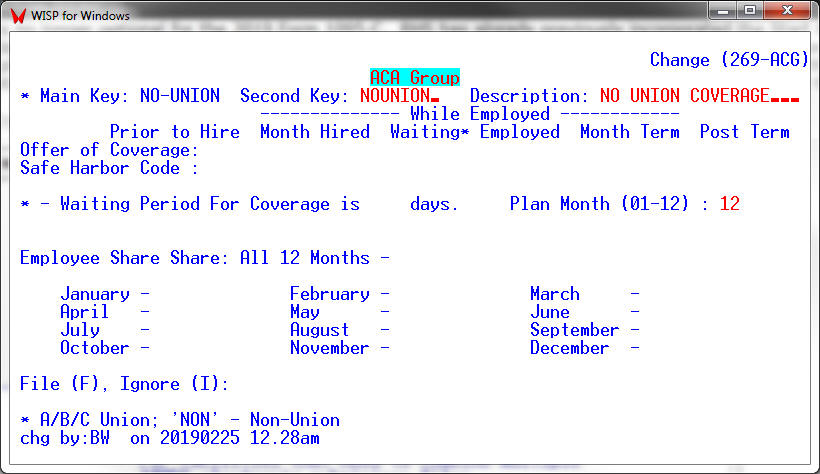

If different groups of employees have different Start Plan Months. The Start Plan Month can be set for each group in the ACA Group Table [CTF, 13, 22].

State Level Reporting

In addition to the federal mandate that requires electronic submission of forms to the IRS, employers also have an obligation to submit returns at the state level in these states: California, New Jersey, Rhode Island, Vermont, and the District of Columbia. Massachusetts also has its own special ACA guidance. Connecticut, Hawaii, Maryland, Minnesota, and Washington have proposed bills to follow suit in upcoming years as well.

New Jersey’s individual health coverage mandate requires third-party reporting to verify health coverage information supplied by individual payers of New Jersey’s Income Tax. The requirement includes both in-state and out-of-state employers who provide health coverage to New Jersey residents. New Jersey‘s electronic filing is due March 31 following the end of the calendar year. Typically only self insured plans need to be reported as most fully insured plans are reported by the insurance carrier. Mailing in paper forms is NOT an option for New Jersey ACA filing.

When submitting forms electronically via Aatrix please make sure that you have marked the appropriate fields to indicate that Aatrix should also submit the required state ACA forms for employees who reside in those states.

Form 1095-C

Although Form 1094-C has not changed for 2021, there are two new Offer of Coverage Codes to be used by employers that are funding ICHRA plans to provide health coverage for their employees (Offer of Coverage Codes 1T and 1U).