Affordable Care Act Update 2020

Filing Deadlines

On October 2, 2020 the IRS announced that it would extend the deadline for employers to provide employees with a copy of their 1095-C reporting form, as required by the Affordable Care Act, from January 31, 2021 to March 2, 2021. March 31, 2021 remains the deadline for electronic submissions to the IRS (submit filing via AATRIX by March 28th to guarantee compliance).

Lowest Cost for Offer of Coverage Code ‘1A’ Increased for 2020

The lowest monthly amount the employee could have paid under the plan for self-coverage only (the cost for covering spouse or dependents is not included) and use Offer of Coverage code ‘1A’ was $99.75 for the 2019 tax year. In 2020 this amount has increased to $101.79 (based on 9.78% of $12,490, the 2019 poverty level). In 2020, if the lowest monthly amount the employee could have paid is less than $101.79 per month for minimum value coverage as defined by the law, Offer of Coverage Code ‘1A’ can be used. If the lowest monthly amount is more than $101.79, Code ‘1A’ cannot be used and the employer should fill in the amount on the form (line 15) and use one of the ‘Safe Harbor Codes’, if applicable, to show that the employee is in compliance.

[For 2021 plans using the Poverty Level Safe Harbor to determine affordability, the employee’s premium payment will not be able to exceed $104.52 per month.]

Plan Start Month

This box on the 1095-C Form, although optional in previous years, is now required. RHS has already incorporated the Start Plan Month in its ACA software. To complete this box on the 1095-C a two-digit number (01 through 12) indicating the calendar month during which the plan year begins of the health plan in which the employee is offered coverage (or would be offered coverage if the employee were eligible to participate in the plan) is entered. If more than one plan year could apply (for instance, if the employer changes the plan year during the year), enter the earliest applicable month. If there is no health plan under which coverage is offered to the employee, enter “00”. To facilitate entering the Start Plan Month for all employees, RHS has provided for a Default Plan Month for the facility and also the ability to override the Start Plan Month for each ACA group.

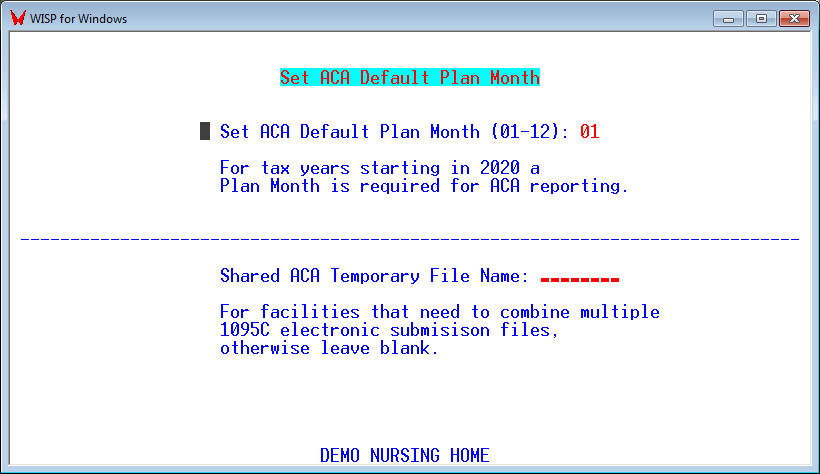

Set ACA Default Start Month – [ACAMONTH – PR, 8, 9, 8]

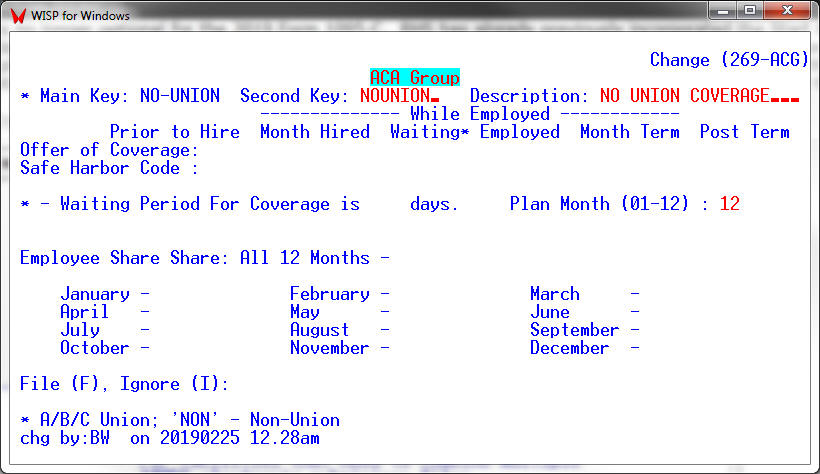

If different groups of employees have different Start Plan Months. The Start Plan Month can be set for each group in the ACA Group Table [CTF, 13, 22].

Except for making the Plan Start Month mandatory, Form 1095-C for 2020 and its instructions remain basically unchanged from the previous tax year.

State Level Reporting

In addition to the federal mandate that requires electronic submission of forms to the IRS, employers also have an obligation to submit returns at the state level in these states: California, New Jersey, Rhode Island, Vermont, and the District of Columbia. Massachusetts also has its own special ACA guidance. Connecticut, Hawaii, Maryland, Minnesota, and Washington have proposed bills to follow suit in upcoming years as well.

New Jersey’s individual health coverage mandate requires third-party reporting to verify health coverage information supplied by individual payers of New Jersey’s Income Tax. The requirement includes both in-state and out-of-state employers who provide health coverage to New Jersey residents. New Jersey‘s electronic filing is due March 31 following the end of the calendar year. Typically only self insured plans need to be reported as most fully insured plans are reported by the insurance carrier. Mailing in paper forms is NOT an option for New Jersey ACA filing.

When submitting forms electronically via Aatrix please make sure that you have marked the appropriate fields to indicate that Aatrix should also submit the required state ACA forms for employees who reside in those states.

Form 1095-C

Although Form 1094-C has not changed for 2020, Form 1095-C has undergone substantial changes from the previous tax year. On Form 1095-C there is a new field for the employee’s age as of January 1. There are also multiple new Offer of Coverage Codes to be used by employers that are funding ICHRA plans to provide health coverage for their employees (Offer of Coverage Codes 1L- 1S). There is a new line, line 17 for Zip Code information if the employee is covered by an ICHRA plan (when Offer of Coverage Codes 1L – 1Q are used).