CHARTS Patch 154 Documentation

This patch contains:

1) Updated Medicare PDPM rates and Wage Index tables, and

2) An updated MCTMT rate table for NYS employers.

Medicare PDM Rates and Wage Index Update

PDPM went into effect starting October 1, 2019. Every October, CMS updates the associated PDPM rates for Urban and Rural facilities along with the wage index for each county. The tables required to calculate expected PDPM payments have been downloaded as part of this release. This update also sets the facility Medicare Wage Index as appropriate for the facility based on the Core Based Statistical Area (CBSA) where the facility is located.

Please note that the software updates the Wage Index based on the Urban or Rural Indicator and CBSA code on file in User Parameters (UP, screen #3).

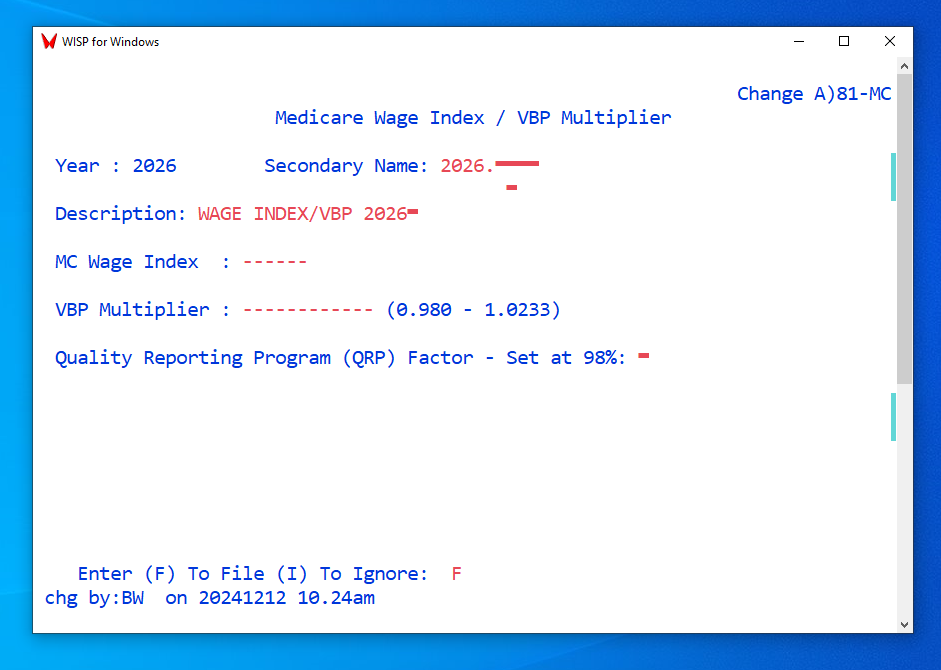

Change Table File (CTF), 8, 34 – Wage Index / VBP Table for fiscal 2026.

For fiscal 2026, the VBP Multiplier is facility specific. Please update the VBP Multiplier as appropriate for your facility.

MCTMT Rate Table Update for New York State Employers

Facilities located in the following two zones of New York State pay Metro Commuter Tax:

- Zone 1 includes the counties of New York (Manhattan), Bronx, Kings (Brooklyn), Queens, and Richmond (Staten Island).

- Zone 2 includes the counties of Rockland, Nassau, Suffolk, Orange, Putnam, Dutchess, and Westchester.

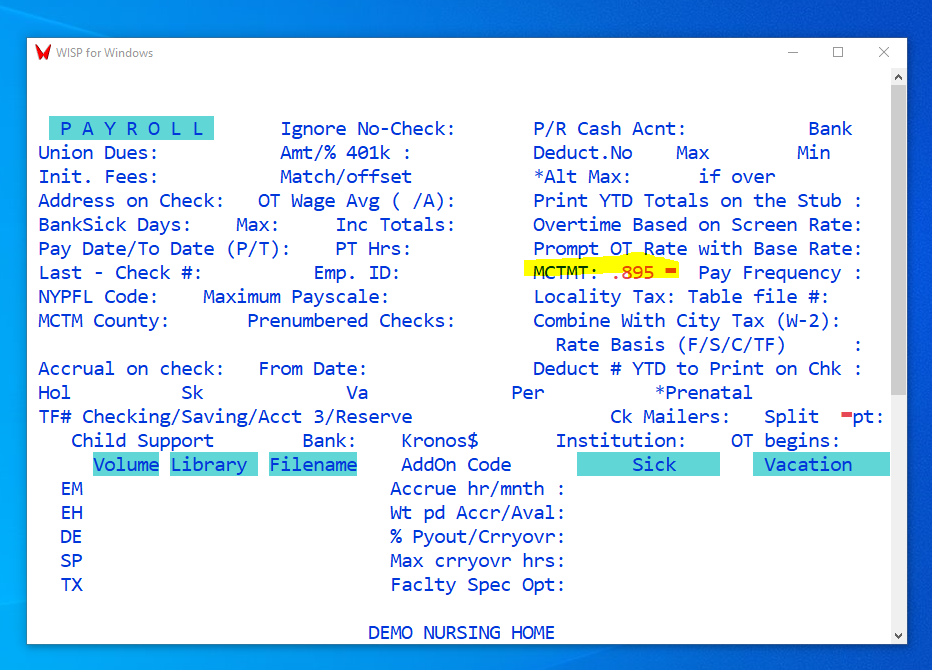

Effective July 1, 2025, the maximum MCTMT rate for NYC employers was increased from .60% to .895%. The new maximum rate will apply to facilities whose payroll expense exceeds $2,500,000 in a quarter. This rate change is in effect for the Zone 1 counties i.e. NYC counties, New York (Manhattan), Bronx, Kings (Brooklyn), Queens and Richmond (Staten Island).

For Zone 2 counties which include Rockland, Nassau, Suffolk, Orange, Dutchess and Westchester counties the maximum MCTMT rate has been increased from .34 to .635%. The new maximum rate will apply to facilities whose payroll expense exceeds $2,500,000 in a quarter.

If these new maximum rates are applicable to your payroll facility, i.e. you expect your payroll expense for the upcoming quarters to exceed 2.5 million dollars, please enter your new applicable MCTMT rate .895 (Zone 1) or .635 (Zone 2) in User Parameters, Screen #5.

User Parameters [UP, 5]

THE END